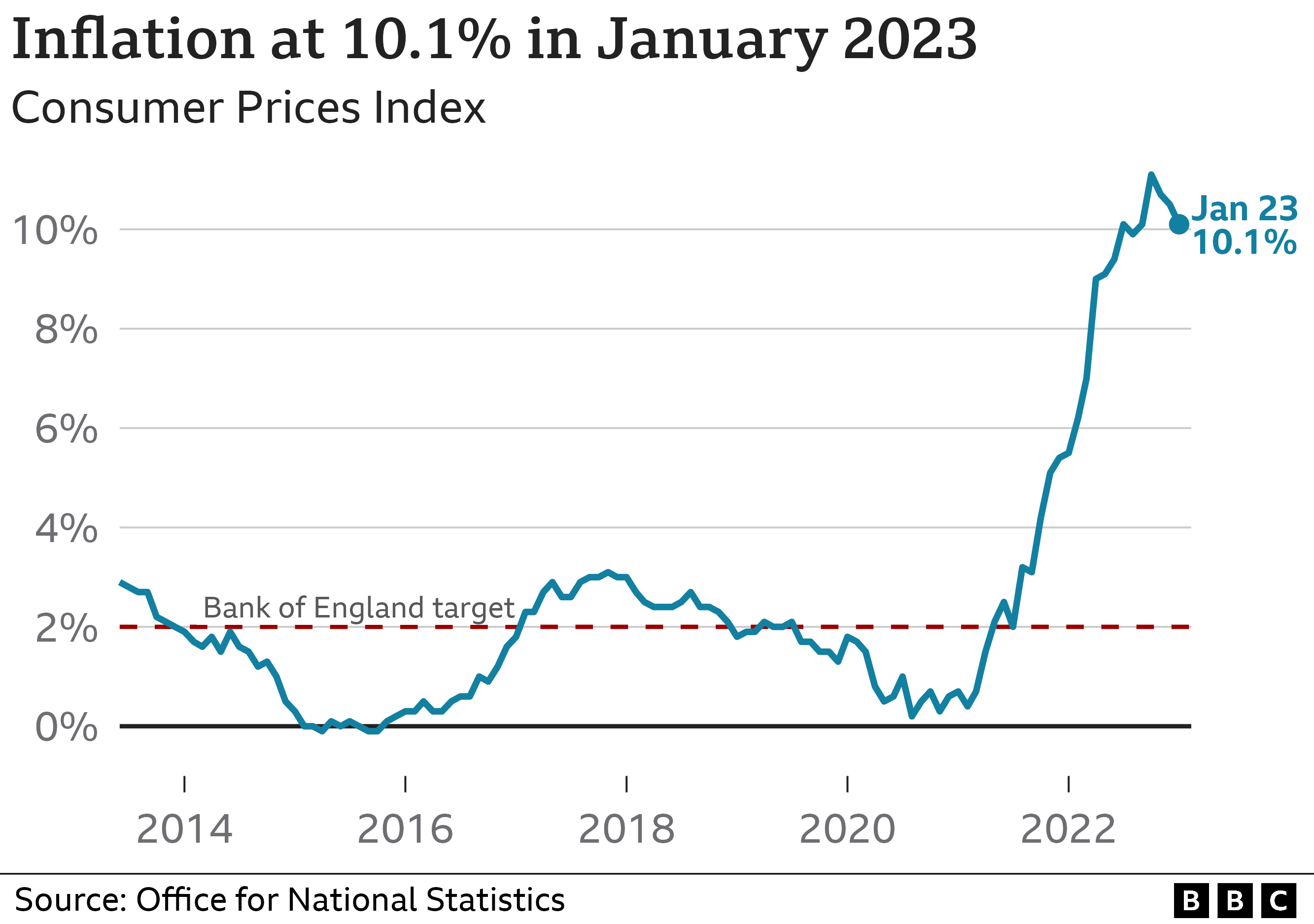

15 February 2023. BBC – The rate at which prices are rising has dropped back slightly, but inflation remains near a 40-year high.

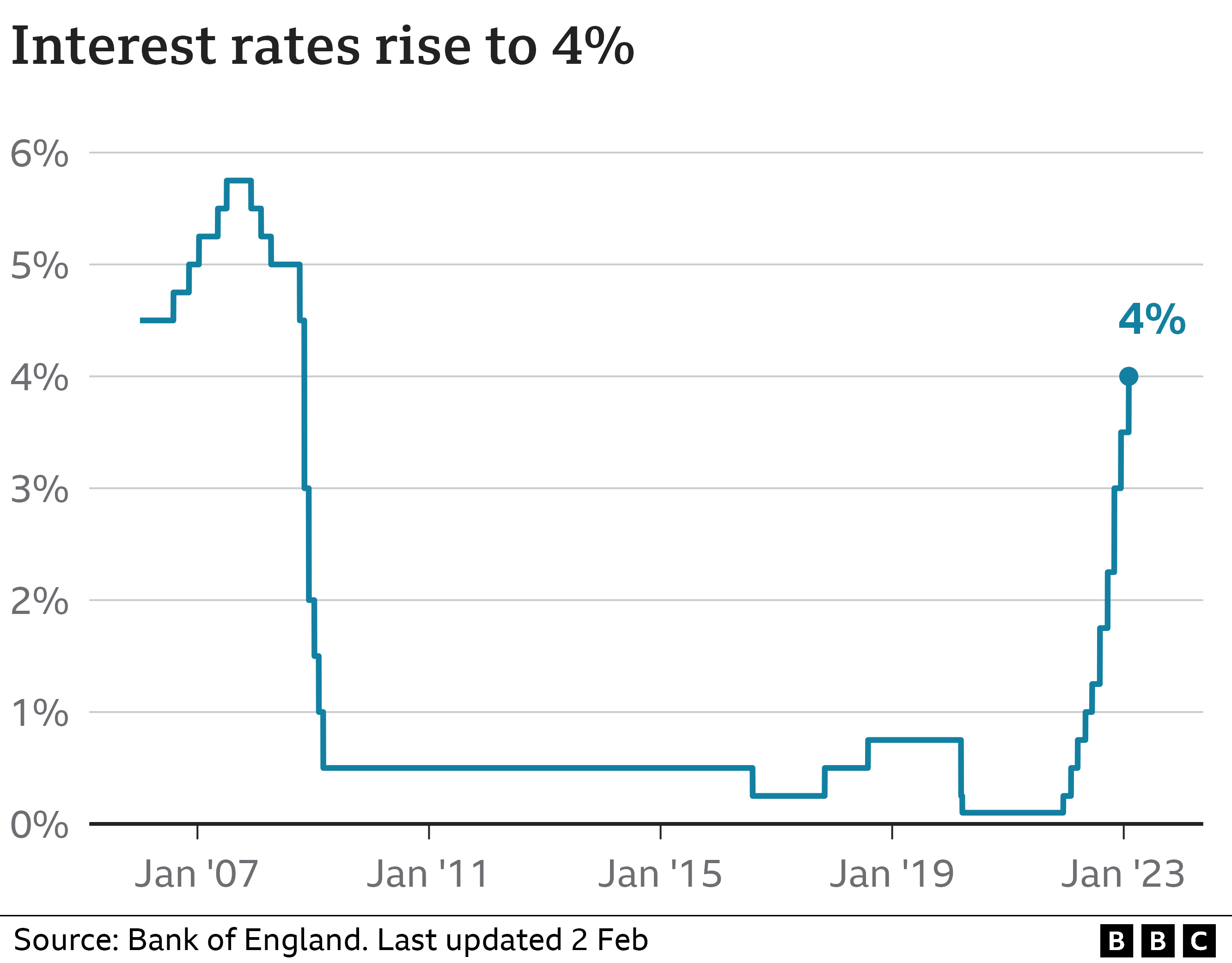

In response, the Bank of England has increased interest rates to 4%, the highest level for 14 years.

What does inflation mean?

Inflation is the increase in the price of something over time.

If a bottle of milk costs £1 but £1.05 a year later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

To come up with an inflation figure, the Office for National Statistics (ONS) keeps track of the prices of hundreds of everyday items in an imaginary “basket of goods”.

The basket is constantly updated. Tinned beans and sports bras were added last year.

Each month’s inflation figure shows how much these prices have risen since the same date last year.

You can calculate inflation in various ways, but the main measure is the Consumer Prices Index (CPI).

The latest figure for CPI was 10.1% in January, down from 10.5% in December 2022.

Why are prices rising so fast?

The soaring cost of energy is a key factor.

Oil and gas were in greater demand as life got back to normal after Covid. At the same time, the war in Ukraine meant less was available from Russia, putting further pressure on prices.

The war has also reduced the amount of grain available, pushing up food prices.

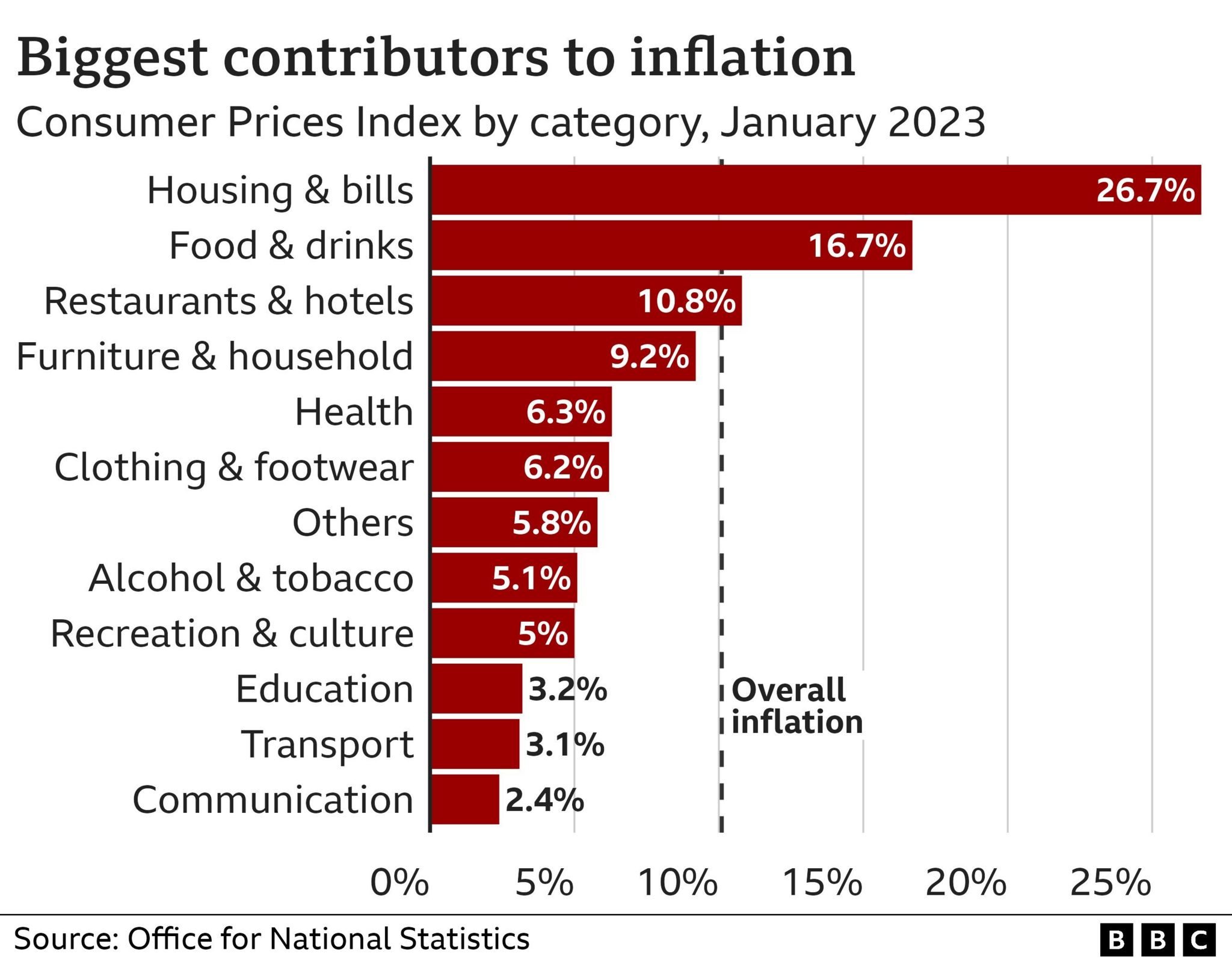

Annual food inflation hit 16.7% in January, the ONS said.

Basics such as milk, olive oil, cheese and eggs saw the largest increases but costs for sugar, jam, honey, syrups, chocolate and soft drinks and juices also jumped.

Are wages keeping up with inflation?

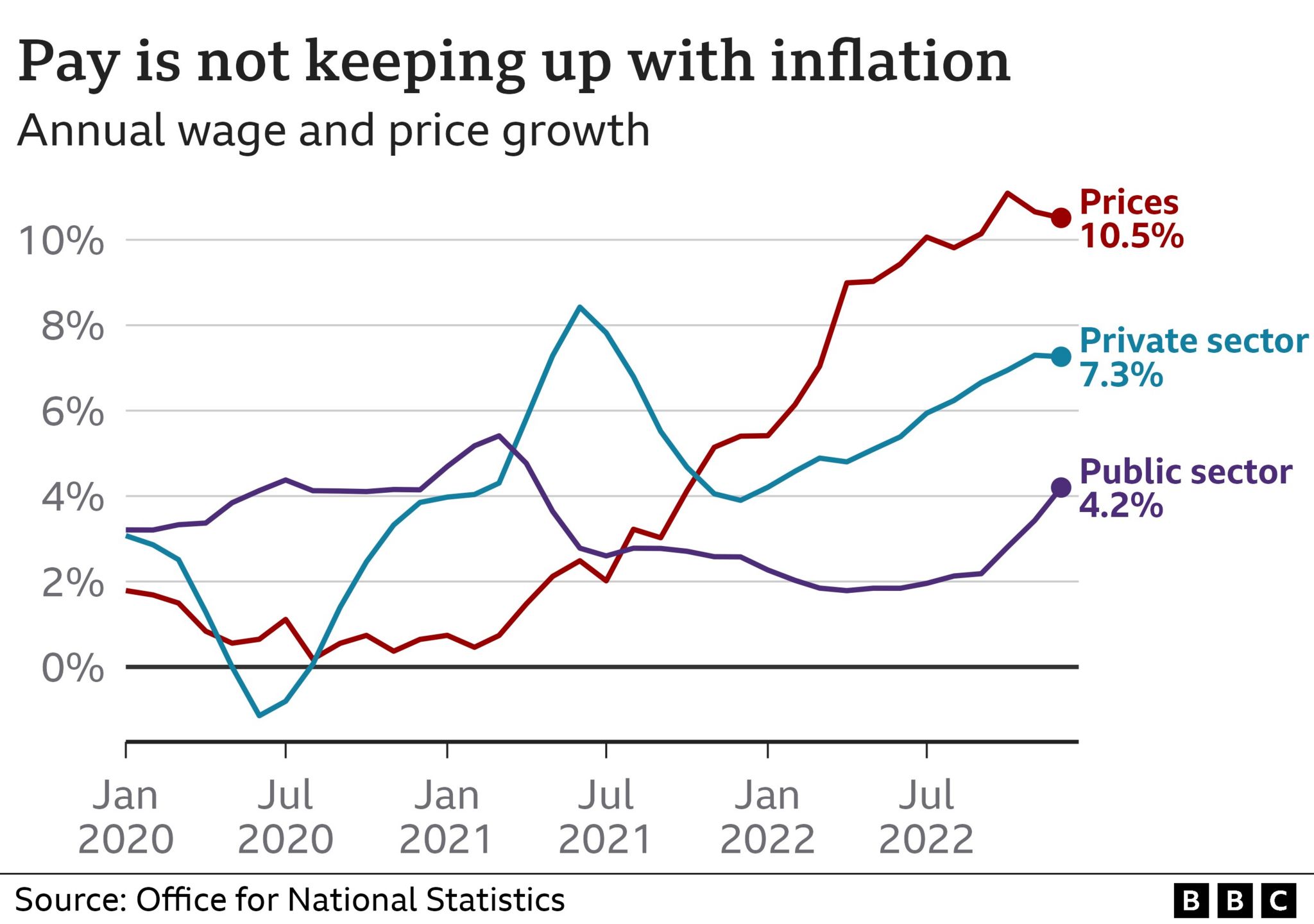

Pay increases for many people aren’t keeping up with rising prices. That’s despite wages increasing by their fastest rate in more than 20 years.

According to official figures, average wages – excluding bonuses – rose by 6.7% in the three months to December 2022, compared with the same period in 2021.

But once inflation is taken into account, average pay actually fell.

There was also a big gap between wage increases for people working in the private sector (7.3%) versus those in the public sector (4.2%).

Unions say wages should reflect the cost of living and many workers are striking over pay.

However, the government argues big pay rises could push inflation higher because companies might increase prices as a result.

What can be done to tackle inflation?

The Bank of England has a target to keep inflation at 2%, but the current rate is still more than five times that.

Its traditional response to rising inflation is to put up interest rates.

This makes borrowing more expensive, and can mean some people with mortgages see their monthly payments go up. Some saving rates also increase.

When people have less money to spend, they buy fewer things, reducing the demand for goods and slowing price rises.

In February, the Bank increased interest rates for the tenth time in a row, taking the main rate to 4%.

The next interest rate announcement is on 23 March.

Rates may rise again.

But when inflation is caused by factors such as global energy prices, action from the Bank of England may not be enough to slow it down.

When will inflation come down?

Lower inflation does not mean prices fall. It just means they stop rising as quickly.

The Bank of England thinks inflation peaked last year, and expects it to keep slowing in 2023, falling to around 4% by the end of the year.

The Office of Budget Responsibility (OBR), which assesses the government’s economic plans, predicts that inflation will fall to 3.75% by the final quarter of 2023 – well below half the current level.

Prime Minister Rishi Sunak said halving inflation by the end of 2023 is one of the government’s five key pledges.

But it is not clear whether he will announce new policies to achieve this, or is just relying on previous interventions.

What’s happening in other countries?

Other countries are also experiencing a cost of living squeeze.

Many of the reasons are the same – increased energy costs, shortages of goods and materials and the fallout from Covid.

The annual inflation rate for countries which use the euro is estimated to have been 8.5% in January.

Inflation is falling in the US too, but is still considered high. Prices rose by 6.4% over the 12 months to the end of January – down from 6.5% in December.