22 February 2023. ABC News – A divide in Congress over the debt ceiling threatens to plunge the U.S. economy into disarray, drawing attention to a looming question: How has the nation’s debt ballooned to $31.4 trillion and what can be done to shrink it?

In fact, economists expect the U.S. debt to grow significantly. In a report last week, the nonpartisan Congressional Budget Office projected the federal debt will grow nearly $20 trillion by the end of 2033.

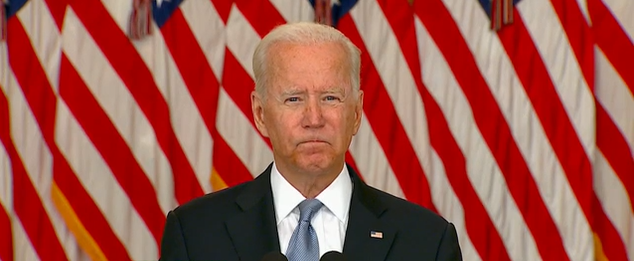

A group of Republican lawmakers has indicated it would not raise the debt limit unless Democrats agree to significant spending cuts; the Biden administration, however, has said it will not take part in policy negotiations conditioned upon the periodic borrowing hike.

Since yearly spending by the federal government exceeds tax revenue, the U.S. has accrued tens of trillions of dollars in debt, almost all of it in the last two decades under both Republican and Democratic presidents.

In order to reverse that trend and achieve an annual surplus, the U.S. would need to either impose a dramatic tax increase or spending cut, or a combination of the two, amounting to a monumental shift in U.S. fiscal policy, experts told ABC News.

Short of that, the U.S. could still make significant but less transformative policy changes in an effort to achieve annual fiscal balance, in which the costs incurred by the government equal the amount of money it raises, allowing the country to stop adding to its debt, they added.

“The car is going off the cliff,” Kent Smetters, a professor at the University of Pennsylvania’s Wharton School of Business who formerly worked at the Congressional Budget Office, told ABC News. “There are pretty big changes needed going forward.”

To be sure, experts differ over the risks posed by the nation’s growing debt. Some economists dismiss concerns about the rising debt as overblown, while others acknowledge that the debt threatens U.S. fiscal health but say the problem should not concern policymakers during lean economic periods.

The last budget surplus for the federal government occurred in 2001. Every year since then, the U.S. has spent more money than it has brought in, deepening the nation’s financial hole. Last fiscal year, interest payments on the nation’s debt amounted to $395.5 billion, or 6.8% of federal spending, according to the Office of Management and Budget.

The trend has resulted from a combination of tax cuts and spending increases overseen by both major parties, experts said.

In the wake of fiscal crises such as the 2008 financial crisis and the COVID-19 outbreak, the federal government spent trillions to stimulate economic growth and support people who had lost their jobs or faced other financial setbacks. Meanwhile the War on Terror, including wars in Iraq and Afghanistan, will ultimately cost the federal government more than $8 trillion, according to a study released by researchers at Brown University in 2021.

Rather than raise taxes to pay for those expenses, the U.S. imposed tax cuts, including two measures signed by President George W. Bush in 2001 and 2003 and later made permanent in partial form by President Barack Obama. Between 2001 and 2018, those tax cuts added roughly $5.6 trillion to the federal debt, the liberal think tank Center on Budget and Policy Priorities found.

The ballooning debt is “absolutely bipartisan,” Maya MacGuineas, president of the Committee for a Responsible Federal Budget in Washington, told ABC News. “There is a lot of finger pointing but they may as well all point the fingers at themselves.”

Achieving annual surpluses, in which the U.S. spends less money than it brings in through taxes and other means, would demand “one of the most dramatic policy shifts that we’ve ever had,” MacGuineas said.

In all, the federal government would need savings of between $10 billion and $20 billion over the next decade to start delivering annual surpluses, MacGuineas said. “We haven’t seen savings of that magnitude in decades, perhaps ever,” she added.

Pursuing a more modest goal, the U.S. could aim to achieve fiscal balance, reaching a point at which its annual expenses equal the amount that it brings in, experts said.

To reach balance within a decade, all spending would need to be slashed by about one-quarter and the necessary cuts would grow to 85% if defense, veterans, Social Security and Medicare spending were considered off limits, the Committee for a Responsible Federal Budget in Washington said.

A budget model at the University of Pennsylvania’s Wharton School found that achieving fiscal balance would require the federal government to hike tax revenues by over 40% or cut expenditures by 30%, or some combination of the two.

Smetters, of the Wharton School, said fiscal balance is akin to a credit card holder who succeeds in meeting his or her monthly payments, even if the level of debt remains unchanged.

“Without balance, the government at some point will fail to be able to make its full interest payments on the debt,” Smetters said. “It doesn’t get us down to zero debt. It just gets us to a level of balance where everything is sustainable.”

The debt will likely grow before Congress addresses it, McGuineas said, citing what she described as a gridlocked political environment in Washington, D.C.

“Long-term compromise and tradeoffs have been cast aside in this dangerously polarized moment,” she said. “It’s precarious in this country right now.”